News for the East Bay's diverse, working-class majority.

Brought to you by the Democratic Socialists of America, East Bay chapter.

December 09, 2019

Student debt cancellation is a demand for racial and gender justice

Photo credit: Sarah Mirk / CC-BY 2.0

By Casey Busher

If you went to college in the last 30 years, this might sound familiar: you get a call from an unfamiliar number with a familiar area code. The person on the other end is a current student at the college you attended, and they’re asking you to donate money to the school.

You don’t want to be rude. After all, they’re not doing this for fun; they’re probably trying to offset the cost of their own education through a work-study program or an internship they hope will land them a decent job down the line.

But you’re also a little indignant. Why would you give money to the school while you’re still paying off their loans? You were told that college was the most important investment you could make in your future. But you’re still paying for it, and while your job might pay better than it would without a college education, you’re far from able to save for things like buying a house or having kids — let alone saving for their college some day, if college tuition stays flat or keeps climbing. Or maybe you, like more than a third of all students who start at a four-year college, left without a diploma because the school wasn’t able to support you through the many financial and social challenges you faced while there.

Student loan debt has increased dramatically over the last decades: one in six people in the US owe money for their education with a combined total of $1.6 trillion. Broad student debt cancellation is more popular and viable than ever. Democratic presidential candidates Sens. Bernie Sanders and Elizabeth Warren and multiple progressive think tanks have come out with their own plans. Some income-based student debt cancellation already exists for those who qualify — and who are aware of those options, and who manage to navigate the paperwork. Warren’s proposal, despite cancelling debt for more people than the current program, has the same issues. Only Sanders’ plan makes public college free and cancels all outstanding student debt in the US.

Who benefits from student debt cancellation?

Some critics — including Democratic candidate for president Mayor Pete Buttigieg — claim that, because high-income families have more academic debt than low-income families, wealthy people stand the most to gain from universal student debt cancellation. Democratic socialists and others on the left argue that this critique is not only in bad faith, it’s wrong for the same reasons that it misses the point.

First of all, the truly wealthy (as Buttigieg says, “the kids of millionaires”) don’t need to take out loans to go to college. Secondly, traditional think tanks underestimate the amount of debt held by low-income people. Finally, when you analyze the burden of debt by looking at it as compared to pre-debt-forgiveness income — in other words, within the context of who’s harmed the most, as opposed to abstract dollar amounts — it’s clear that student debt cancellation makes the greatest difference not for the wealthy but for those who need it most.

Student debt disproportionately burdens women, people of color, and poor people — the people who are most likely to need crushing loans in order to attend college. Cancelling student debt is both a gender and racial justice issue.

Women, and in particular black and Latina women, take on more student debt to attend college than men do. According to a new report from the American Association of University Women, women make up 56% of US college students, but they hold nearly two-thirds of outstanding student debt. That means the average woman graduating from college owes $2,700 more than the average man. After graduation, the wage gap only exacerbates the problem. White women earn 79% of the annual median earnings of their white male counterparts, while black women earn 62% and Latina women just 54%. Women, and especially women of color, have less income to pay back their loans and spend an average of two extra years in debt after leaving college.

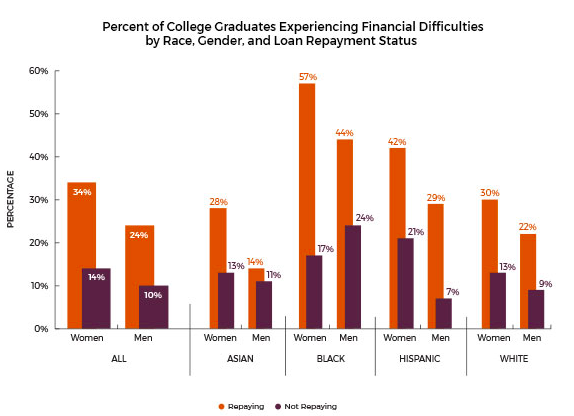

Debt is not just an inconvenient monthly bill on top of other financial obligations. Of all surveyed women repaying student loans, 34% percent reported that they weren’t able to meet essential expenses within the past year. Among black women repaying loans, the number was 57%.

Black women, the most highly educated group by race and gender in America, carry the highest burden of student debt in the US, with an average of $30,366 at graduation. That’s $10,880 — almost 56% — more in debt than the average white man on graduation day. And black undergraduate students of all genders are unable to repay their loans at rates five times higher than their white peers.

Debt holds millions of people hostage across the US and impacts their lives over decades. People with debt are less able to buy a home, less able to have children when they want them, and less able to retire when they need to. Research has also linked debt to higher rates of anxiety and depression.

The predatory lenders behind the student debt crisis

With working women of color shouldering a disproportionate share of US student debt, it’s clear that framing debt cancellation as a giveaway to elites is disingenuous and wrong. So who benefits from pretending that debt cancellation is for the privileged — and that the system is working just fine as is?

One beneficiary of this lie is Sallie Mae, the student debt profiteer that reported a net interest income of $383 million last year. Formerly the Student Loan Marketing Association, the company used to service federal student loans as a national federal agency; now it targets students through private loans, which offer fewer protections to borrowers. Meanwhile, Sallie Mae’s spin-off company Navient Corporation, which services 25% of US student loans and serves as the US government’s student debt collections agency, makes $5.18 billion in annual revenue.

Sallie Mae recently made headlines for sending 100 executives to a Hawaiian resort to celebrate a record year: $5 billion in student loans. As these predatory lenders are drinking blended cocktails poolside, millions of their customers are struggling to keep roofs over their heads.

Paige McDaniels, who owes over $300,000 fourteen years after taking out a loan, declared bankruptcy after Navient threatened to put a lien on her house and garnish her wages. She is suing Navient, along with attorneys general in several states, but she shouldn’t have to. Especially as higher education becomes a prerequisite for full-time jobs with livable wages, it’s unconscionable to leave this power in the hands of for-profit lenders.

Student debt is an urgent crisis that disproportionately affects working class people, women, and people of color. Sanders’ proposal for universal student debt cancellation would increase mobility and income and offer freedom from debt to the people most harmed by institutional oppression and capitalism.

It also goes further than that, expanding public education from K-12 to higher education. And it addresses the racial inequalities in student debt by investing $1.3 billion every year in historically black colleges and universities, expanding Pell Grants to cover costs outside of tuition and tripling funding for work-study programs. Sanders’ plan is not only the boldest plan in the Democratic primary — it is an urgent call for gender and racial justice.